Colorado UI Guide: Forms, Claims & Resources

Are you a Colorado employer navigating the complexities of unemployment insurance? Understanding your obligations and accessing the right resources is paramount to compliance and protecting your business from potential fraud.

In the state of Colorado, employers are responsible for adhering to specific regulations regarding unemployment insurance (UI) taxes. This system, managed by the Colorado Department of Labor and Employment (CDLE), is funded by employer contributions and provides temporary financial assistance to workers who have lost their jobs through no fault of their own. For businesses, navigating these requirements can be daunting. This article aims to clarify the key aspects of UI in Colorado, offering guidance on establishing accounts, filing returns, and accessing essential resources. Furthermore, it will examine measures to prevent fraudulent claims, which are a significant concern for both employers and the state.

If you are a federal employee who has been recently laid off, you may be eligible for unemployment benefits. It's crucial for taxpayers to understand their rights and obligations regarding these benefits, especially concerning tax implications. The primary purpose of this is to inform both the taxpayer and the IRS about income received that may be taxable. The information provided herein is for general guidance only and should not be considered as a substitute for professional legal or financial advice. The rules and regulations are subject to change, and it is important to consult the official sources for the latest updates.

| Category | Details |

|---|---|

| Key Requirement for Colorado Employers | As a Colorado employer liable for UI taxes, your small business must establish a Colorado UI tax account with the Colorado Department of Labor and Employment (CDLE). |

| Account Registration | You can register for an account with CDLE either online or on paper. Once registered, you'll be issued a UI tax account number. |

| Online Access | Often you will have access to your tax forms online if there is an online account where you manage your benefits, providing convenient access to necessary documents. |

| FUTA Credit & Forms | The FUTA credit may also be referred to or used in conjunction with the following terms or forms: Employer's annual federal unemployment (FUTA) tax return. |

| Additional Accounts | You can also create a wage withholding account and sales tax license from that page, streamlining your tax management. |

| Exclusion of Unemployment Compensation | Excluded unemployment compensation by transferring the amount listed on their federal Schedule 1, Line 8 (IRS Form 1040) to Other Additions on Line 6 of their Colorado DR 0104 income tax return. |

| Court Decision Impact | A recent court decision determined that the rule was incorrect and that retroactive changes in federal law can affect a. |

| Address Change | Unemployment Insurance (UI) operations has moved from 1515 Arapahoe Street to 251 East 12th Avenue. This is essential information for anyone needing to visit or send correspondence to the UI office. |

| Reporting Deadlines | Reports are due by the last day of the month immediately following the quarter being reported. |

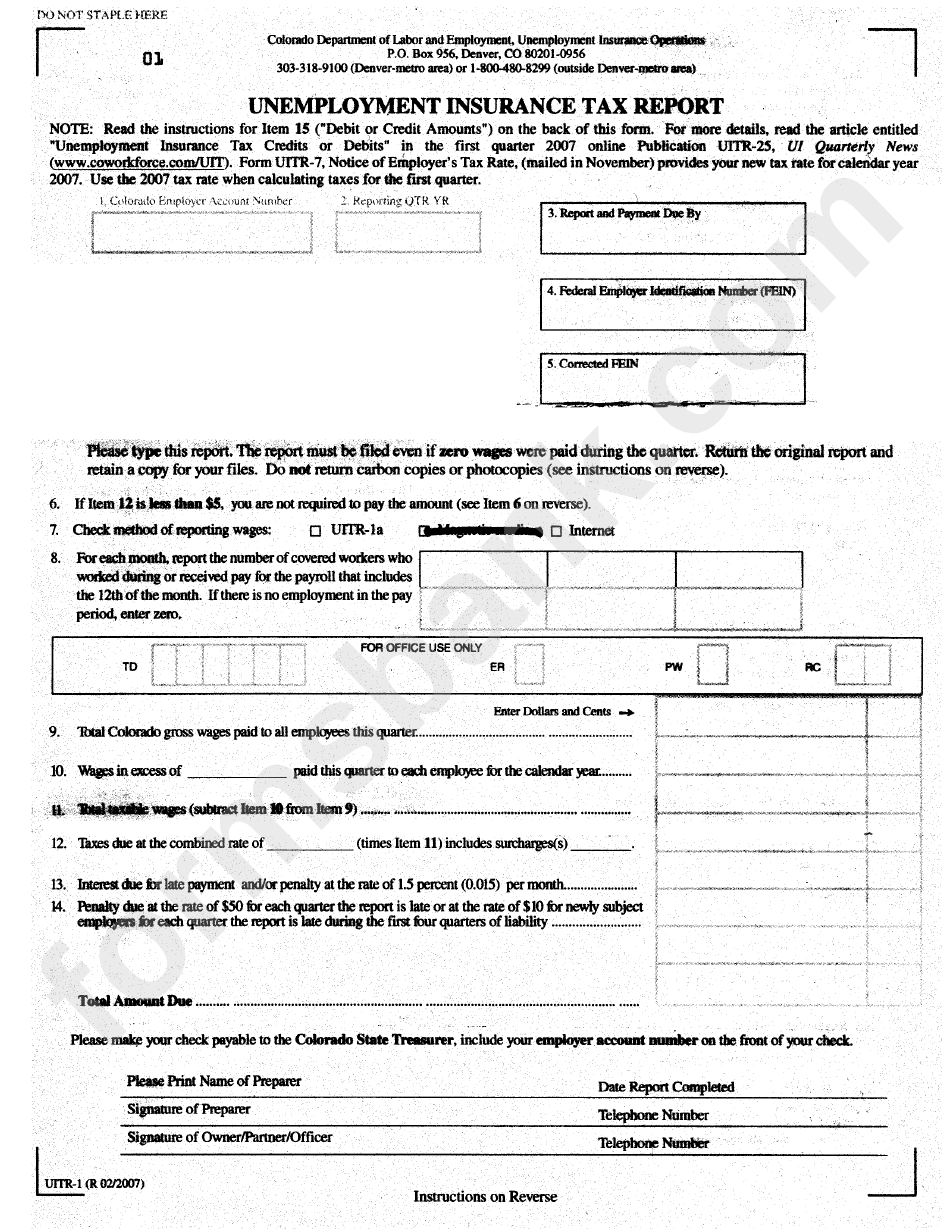

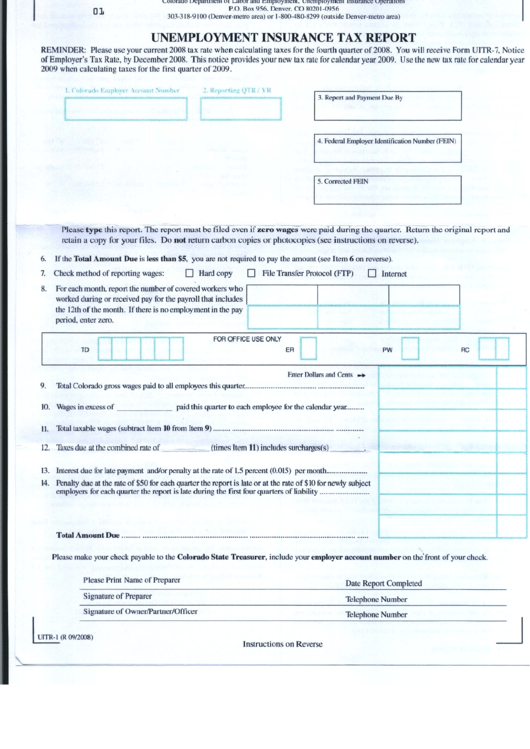

| Wage Reporting Forms | This will arrive in the mail at the end of the months of March, June, September, and December. It is used to report your employee wages which are subject to Colorado unemployment insurance taxes. |

| Payroll Services | ASAP Accounting & Payroll, Inc. Files this tax return for all payroll service customers each quarter. |

| Customer Service Locations | Division of Unemployment Insurance Customer Service Lobby: 621 17th Street, Suite 100 Denver, CO 80202. It offers a physical location for in-person assistance and document submission. |

| Colorado Payroll Taxes | There are two statewide payroll taxes that Colorado employers are responsible for: The Colorado State Unemployment Insurance (SUI) tax, which is administered by the Colorado Department of Labor and Employment (CDLE), and the Colorado Wage Withholding tax, which is administered by the Colorado Department of Revenue. |

| Obtaining an Account Number | How do I get an unemployment insurance tax account number? The Colorado Department of Labor & Employment provides clear instructions on this process. |

| Form Submission | The form must be signed in. If this form is not signed, it cannot be processed. Ensuring proper form completion is crucial for processing. |

| Business Changes | Part IIChange of Ownership/Termination of Business or Employment. Sole proprietorship or partnership incorporating are considered as new businesses. Change of ownership includes changing 50 percent or more in a partnership. |

| Employee Notification | Notice of potential availability of unemployment insurance benefits attention employer: You are legally required to provide a form, in hard copy or electronic format, to an employee upon separation. Please complete the form using information that matches your employee payroll records. |

| Tax Filing Instructions | To learn how to file your tax return if you receive unemployment compensation, read Do I Have to Pay Taxes on My Unemployment Benefits. Understanding tax implications is essential for recipients. |

| Tax Year Selection | Select the tax year you are filing for to be directed to the forms for that year. |

| Minimum Wage | 2025 Minimum Wage $14.81 / hour $11.79 / hour for tipped employees |

| Online Account Access | MyUI Employer is a secure system giving employers online access to their unemployment account information 24 hours a day, 7 days a week. Have the convenience of accessing forms, data, reports, information, and anything else you need to do online. |

| Account Closure Instructions | Instructions for closing Colorado unemployment account: Complete part I with your business information, including your unemployment account number. |

Navigating the unemployment insurance landscape in Colorado begins with establishing a UI tax account. This is a fundamental requirement for all employers subject to UI tax. The CDLE provides two primary methods for registration: online and paper-based. The online registration process is often considered the more efficient route, allowing businesses to quickly establish their account and access necessary forms and information. Paper registration, while available, may take longer to process. Regardless of the method chosen, upon successful registration, the employer is issued a unique UI tax account number. This number serves as an identifier for all interactions with the CDLE regarding UI matters, including wage reporting, tax payments, and benefit claims. The CDLE's online portal, often accessible through the Colorado Business Express platform, provides a central hub for managing your UI account.

Once registered, employers gain access to a wealth of resources. Tax forms are typically available online, streamlining the filing process and providing immediate access to essential documents. The online portal also allows employers to manage their benefits effectively, view account information, and stay informed about changes in UI regulations. It is crucial for employers to understand the importance of accurate and timely reporting of employee wages subject to Colorado unemployment insurance taxes. These wage reports are the basis for determining employer contributions and for calculating the benefit amounts for eligible claimants. Failure to comply with these reporting requirements can result in penalties and may jeopardize the employer's good standing with the CDLE.

Another important aspect of the UI system in Colorado is the Federal Unemployment Tax Act (FUTA) credit. This credit, often used in conjunction with the employer's annual Federal Unemployment (FUTA) tax return, provides a mechanism for businesses to offset their federal unemployment tax liability. Eligibility for the FUTA credit is dependent on the timely payment of state unemployment taxes, among other factors. Understanding how to claim the FUTA credit is crucial for minimizing overall tax obligations.

The Colorado Department of Labor & Employment (CDLE) plays a central role in the administration of UI in the state. The department is responsible for collecting UI taxes from employers, processing claims for unemployment benefits, and providing customer service to both employers and claimants. It is vital for employers to stay informed about CDLE guidelines and regulations. The CDLE regularly publishes resources, including forms, publications, and updates to its website. Employers are encouraged to regularly consult these resources to ensure they are in compliance with all applicable requirements.

A critical component of responsible UI management is the prevention of fraudulent claims. Fraudulent claims can be costly for businesses, increase UI tax rates, and divert resources from legitimate claimants. The CDLE has implemented several measures to detect and prevent fraud, and employers are encouraged to actively participate in these efforts. This involves promptly responding to requests for information from the CDLE, thoroughly verifying the eligibility of former employees who file for benefits, and reporting any suspected fraudulent activity. Protecting yourself and helping prevent fraudulent UI claims are essential for the health of the UI system.

The importance of understanding tax implications of unemployment benefits is also an important aspect. To understand how to file your tax return if you receive unemployment compensation, read "Do I Have to Pay Taxes on My Unemployment Benefits". This guidance is essential for recipients of unemployment benefits and helps them fulfill their tax obligations.

Colorado employers should also familiarize themselves with the wage withholding tax. There are two statewide payroll taxes that Colorado employers are responsible for. The Colorado State Unemployment Insurance (SUI) tax, which is administered by the Colorado Department of Labor and Employment (CDLE), and the Colorado Wage Withholding tax, which is administered by the Colorado Department of Revenue. Ensuring correct compliance is also crucial for the financial health of businesses and employees.

The CDLE provides various contact options for employers, including customer service lobbies, and online portals. They will offer guidance and support to employers navigating the intricacies of unemployment insurance. Employers needing help may contact the Division of Unemployment Insurance Customer Service Lobby 621 17th Street, Suite 100 Denver, CO 80202.