Chase Homebuyer Grants: Save $2,500 Or $5,000!

Are you dreaming of owning your own home, but unsure where to start? Navigating the complexities of the real estate market can be daunting, but with the right resources and guidance, your dream of homeownership can become a reality.

The path to homeownership often involves several crucial steps, and understanding these steps can significantly improve your chances of success. One key aspect is securing the right financing. This is where financial institutions like Chase come into play, offering a variety of products and services designed to support prospective homebuyers.

Chase, for instance, provides a range of financial products and services, encompassing checking and savings accounts, credit cards, home loans, auto financing, and investment opportunities managed by J.P. Morgan. Furthermore, Chase Online offers a convenient platform for managing your accounts, viewing statements, monitoring account activity, paying bills, and securely transferring funds from a central location. Beyond these core services, Chase offers valuable tools and resources to assist you in the home-buying process.

In an effort to make homeownership more accessible, Chase provides the "Chase Homebuyer Grant." This grant can potentially save you money at closing, offering either $2,500 or $5,000 towards your new home in select areas across the country. It's essential to note that the Chase Homebuyer Grant is specifically available for primary residence purchases. You may be eligible for these savings when applying for a Dreamaker, standard agency, FHA, and VA home purchase mortgage loan product. Additionally, census tract requirements apply in certain instances.

Beyond financing, understanding the dynamics of the real estate market is crucial. The market type can significantly impact the value of your home. For instance, a "seller's market," characterized by fewer homes for sale compared to the number of buyers, can make your home a highly sought-after commodity, potentially driving up its value. Conversely, in a "buyer's market," where there are fewer buyers than available homes for sale, this could potentially drive down the value of your home. Various factors can influence your home's value, including other properties in your neighborhood.

If you're considering selling your home, working with a real estate agent is key. Your agent will guide you through the process. Once the home is sold, the proceeds from the sale are distributed after the closing costs and commissions are paid. If the buyer pays more for your home than you owe on all the liens against the property, you will receive the net proceeds.

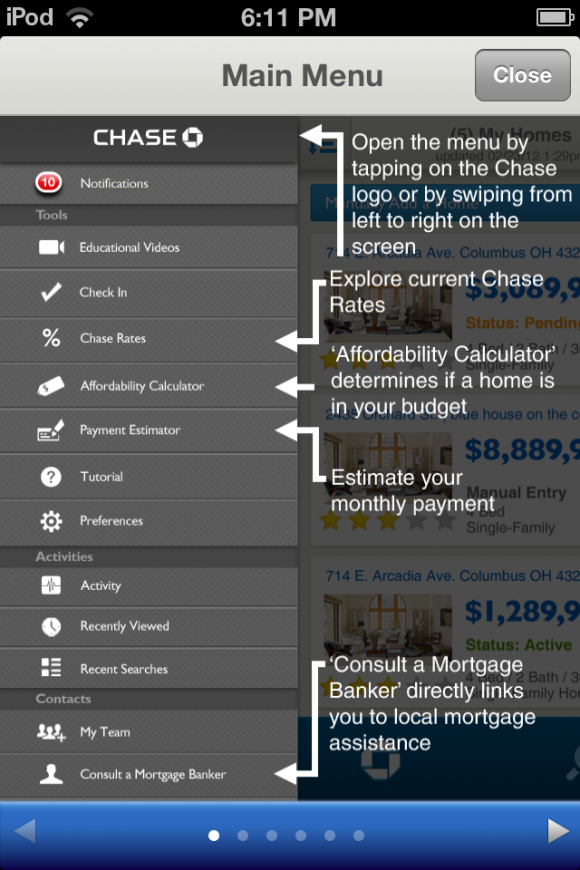

To assist you throughout the homeownership journey, Chase offers Chase MyHome, a digital platform designed to support you at every stage, from finding and applying for loans to managing your mortgage and equity. By signing in with your Chase account, you can access home insights, rates, properties, and grants. Chase also provides refinancing options, enabling you to lower your monthly payments, pay off your loan sooner, or access cash for a significant purchase. Furthermore, Chase offers a home value estimator to determine the current value of your home.

Chase Home Lending offers online tools and resources to help you find, afford, and buy a home. You can compare rates, explore loan options, apply online, and get guidance from Chase experts. The resources available encompass various aspects of the home-buying process, including determining how much house you can afford, estimating your monthly payment with a mortgage calculator, and seeking preapproval for a mortgage.

The preparation and presentation of your home can significantly impact your selling experience. Staging your home can attract more prospective homebuyers and potentially speed up the selling process. By presenting your home in the best possible light, you can increase its appeal and captivate the attention of potential buyers. A well-staged home can make a significant difference in today's real estate market.

For those seeking answers to their queries, contacting Chase customer service is an option. You can also provide feedback or register any complaints. Chase's commitment to customer service ensures that you have the support you need. The banking education center is also an option, where you can find additional details.

Chase understands that each individual's needs are unique, offering a broad range of products and services. In addition to its online platform, Chase offers a variety of mortgages for buying or refinancing a home, as well as home equity loans. Manage your account online, get mortgage calculators, access educational resources, and receive customer service. Please note that Chase's website and/or mobile terms, privacy, and security policies may not apply to external sites or apps you are about to visit. Ensure that you review their terms, privacy, and security policies.

If you want to discuss your options, contact a Chase Home Lending Advisor. Chase's commitment to providing customers with valuable resources to help navigate the home buying process and other financial matters is clear. With a range of tools and products, the company seeks to empower individuals to achieve their financial goals.

Finally, remember that the market's dynamics can change. Staying informed about market conditions and seeking guidance from professionals can improve your chances of success in this area.