Colorado 1099 Filing: What You Need To Know + DR 1106 Filing

Are you prepared for the annual tax season in Colorado? Navigating the state's tax requirements, particularly those related to 1099 forms, can be a complex task, and staying informed is essential to avoid penalties and ensure compliance.

The world of tax compliance, particularly when it comes to state-specific regulations, often presents a labyrinth of requirements. For businesses and individuals operating within the state of Colorado, understanding the nuances of 1099 form filing is paramount. It's not merely about submitting the federal forms; Colorado imposes its own set of rules, necessitating a keen understanding of the procedures and deadlines.

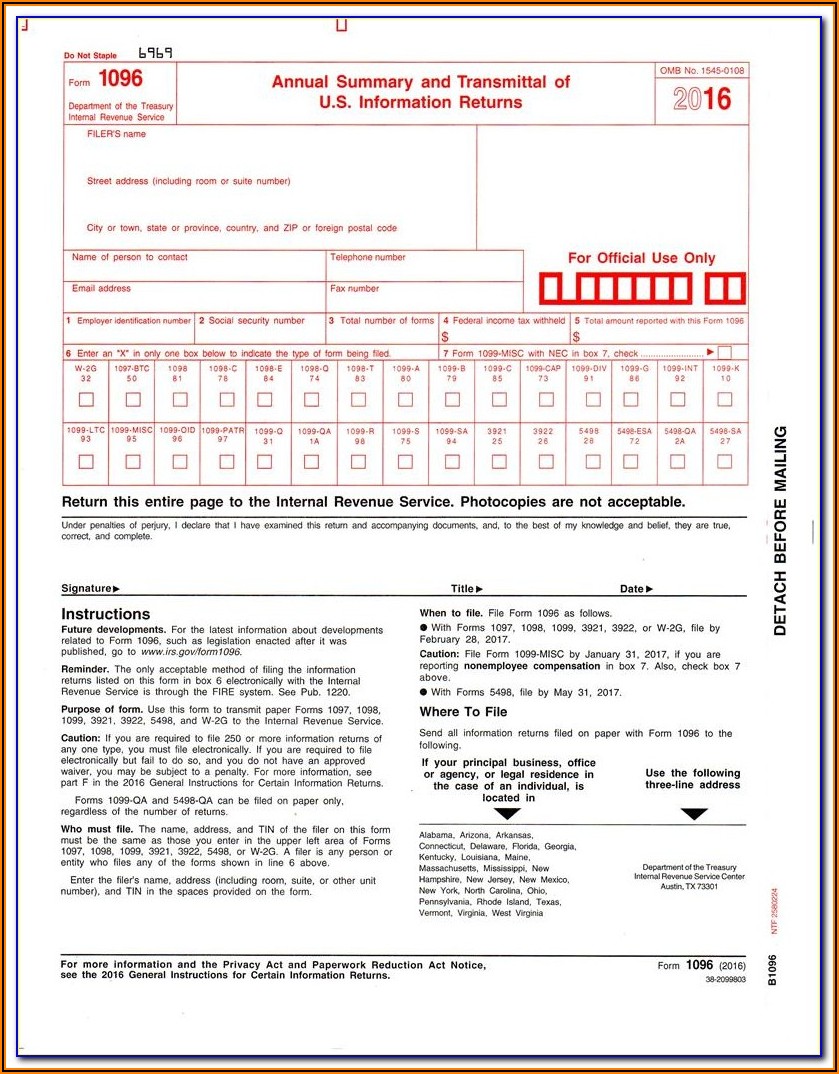

One of the initial questions that arises for many is, "Can I efile 1099 forms with Colorado?" The answer, as we'll explore, is nuanced and hinges on the volume of forms you're required to file. Electronic filing has become increasingly prevalent, but its crucial to know when it's mandated and the available methods. Furthermore, the process doesn't stop with the standard 1099s; Colorado requires an additional form, the DR 1106 (Annual Transmittal of State 1099 Forms), adding another layer of complexity.

The DR 1106 form serves as an annual transmittal for the state's 1099 forms, a critical component of Colorado's tax reporting system. This form, alongside the 1099s themselves, must be submitted to the Colorado Department of Revenue. The deadline for filing is an important consideration, as missing the date can lead to penalties. The DR 1106 is generally filed in January, aligning with the reporting of withholding taxes detailed on the federal 1099 forms.

For those grappling with income withholding tax in Colorado, the DR 1107 Income Withholding Tax Return plays a specific role. This form is applicable for current year 1099 withholding only, adding another element to the overall tax landscape. It's important to understand the situations where this form is required and how it integrates with the broader tax filing obligations.

Let's delve into the specific requirements and procedures to ensure compliance with Colorado's tax regulations. The key is to approach the process with accuracy and attention to detail.

The Colorado Department of Revenue requires the filing of all 1099 forms. This is a fundamental point to understand. This requirement necessitates that payers submit an annual information return, including 1099s, if Colorado tax is withheld from any income earned. This ensures that the state receives accurate information regarding income and withholding for its tax administration purposes.

When dealing with the state's tax framework, the forms that you need to file with Colorado are:

- The state copy of form 1099

- Form DR 1106 (Annual Transmittal of State 1099 Forms)

- Potentially, form DR 1107 Income Withholding Tax Return

The deadline for filing the state copy of Form 1099 is by March 31st. However, it's important to stay updated as filing deadlines can be subject to change by the Colorado Taxation Agency.

A critical aspect of Colorado's 1099 filing rules is the electronic filing mandate. If you file 250 or more 1099 forms with Colorado, you are required to file them electronically. This rule is designed to streamline the submission process and enhance efficiency for both taxpayers and the Department of Revenue.

Amending a tax return is sometimes necessary. If you need to amend a return in Colorado, it's mandatory to mark the "Amended Return" box on the form. Furthermore, the amended return must accurately reflect all the tax columns, ensuring all corrections are made, not just the differences.

Colorado offers various resources to assist taxpayers. You can file your state income taxes online, providing a convenient and efficient method for submitting your return. The state also provides the ability to submit documentation electronically, further simplifying the process. Furthermore, you can apply for a Property Tax/Rent/Heat Credit (PTC) rebate, if applicable.

For individuals and businesses alike, the state offers Revenue Online as a tool for managing tax accounts. This online portal provides access to various features, including payment options and account management tools.

The role of the 1099 is to report the income of the non-employee who is not on payroll. It is not, in itself, a declaration that a person is a contractor. Our statute outlines the minimum criteria to consider when establishing a working relationship. The distinction between an employee and a contractor has many implications and impacts on your filing requirements.

Consider the benefits of hiring an employee.

- Benefits: Employee benefits include health, dental, and retirement plans. These programs are critical when it comes to retaining high quality talent.

- Employer Contributions: Employees have taxes, such as Social Security and Medicare, withheld from their paychecks. However, employers are required to match the same amount, adding to the employers cost to have them.

- Legal Protection: Having an employee limits the employers liability when it comes to employment practices.

- Time Off: Employees get holidays and personal time off.

Consider the benefits of hiring a contractor.

- No Payroll Taxes: Contractors pay their own payroll taxes. This can save the business money.

- Less paper work: The 1099 is far easier to prepare than a W-2.

- Flexibility: Contractors can be released whenever their work is done.

- Cost: Contractors are paid only for the work they perform. You pay them for the project, and not for the time.

Tax incentives exist for families who are saving for college, are already paying for college, or who are repaying student loans. Explore all the available options to ensure you benefit from every incentive you are eligible for.

The state of Colorado provides many tools and resources for taxpayers. From online filing to specific information on tax types and payments, make sure you are taking advantage of all the tools available to you.

For the most current version of each form, always refer to the official Colorado Department of Revenue website. Only the most recent versions of forms are published.

If you are looking for prior year forms, you can contact the Colorado Department of Revenue by emailing dor_taxpayerservice@state.co.us.

It's important to be aware of all available resources and methods to help you with your tax filing.

For further information or assistance, consult the official Colorado Department of Revenue website or seek guidance from a qualified tax professional.